In this post, we explore the efforts to deal with CMS payment cuts to home health through new legislation.

In my last four blog posts, we reviewed the NAHC lawsuit against CMS and the four rounds in their legal debate, two by each side. Now that CMS has presented their rebuttal, we will need to wait for the judge to make a ruling.

Whatever the ruling might be, it is unlikely to be the end of the process since appeals could be made by either party. As it stands, it would be to the benefit of CMS to delay any resolution as long as possible since each day represents millions in savings on home health spending through their implementation of the behavioral adjustment. Considering this situation, you can expect CMS to delay any outcome outside of a dismissal of the case.

In addition to this effort by NAHC to influence CMS through a legal argument, the organization is also spearheading an effort to get congress to act through legislation. Thanks largely to their efforts, a bill has been introduced in both the senate and the house intended to stop the CMS cuts targeted toward home health.

In the Senate, the bill (S.2137) was introduced 6/22/23 and was immediately forwarded to the Finance committee.

In the house, the bill was introduced 8/4/23 and then forwarded to the Ways and Means committee which assigned it to their subcommittee on health.

The site congress.gov tracks the status of these bills once they are introduced, you can create an account and track these bills with alerts when their status changes. These images reflect the status of each bill when this post was written.

In the lawsuit, the idea is to present legal arguments supporting your case in an effort to get a judge to agree with your point of view. The arguments presented by NAHC and CMS in the lawsuit are not framed as emotional appeals intended to get support for their position based on fairness or equity, but legal arguments intended to settle the dispute based on the relative strength of their positions as supported under the existing laws and legal precedent. In this scenario, one person needs to be convinced, the judge.

In the legislative efforts, the process is completely different. The discussion is no longer related to the merits of the arguments from a legal perspective. It is about taking sides. More specifically, from a home health advocacy perspective, it is about presenting arguments to legislators in order to convince them that the current CMS payment cuts are a threat to the home health industry. In this effort, it is about influencing the hearts and minds of legislators using whatever means you have at your disposal.

Typically this translates into an effort to convince these individuals that it is in the best interest of their constituents, and themselves, to support and pass these bills. These efforts do not have to be based on logic, precedent, or even the merits of the argument. In order to succeed, they need to convince the legislators that the situation is a crisis that needs immediate attention. This is how bills were created and passed to provide additional Medicare funding during the pandemic for hospitals.

From the perspective of these legislators, we assume that they listen to arguments from both sides. From the home health perspective, NAHC and others have developed campaigns for home health stakeholders to contact their senators and congressmen and relate to them the difficulty they are experiencing financially and what they feel is the expected outcome if the problem is ignored. In other words, the home health advocacy strategy is based on getting their collective complaints heard by congress.

On the CMS side, we have MedPAC, which provides reports to congress on the financial health of the industry. These reports are presented from a perspective of total spending on healthcare by the federal government and how these costs are being managed by CMS.

When congress considers these issues, they weigh the benefits of reduced government spending against the impact of these cuts. Specifically on this issue, they might typically review the information from MedPAC as it relates to home health against the many individual arguments they have heard to the contrary.

MedPAC produces a report annually for congress on this topic. It is called the “Data Book on Healthcare Spending”. The most recent one is from July of 2023. In this report, MedPAC uses data from the cost reports to analyze the financial performance of each healthcare sector so that congress can make educated decisions when it comes to Medicare spending versus the financial impact to providers and the availability of these services to patients (voters). Due to the lag in cost report data availability, the 2023 MedPAC report, written in July 2023, uses data from cost reports through the end of 2021.

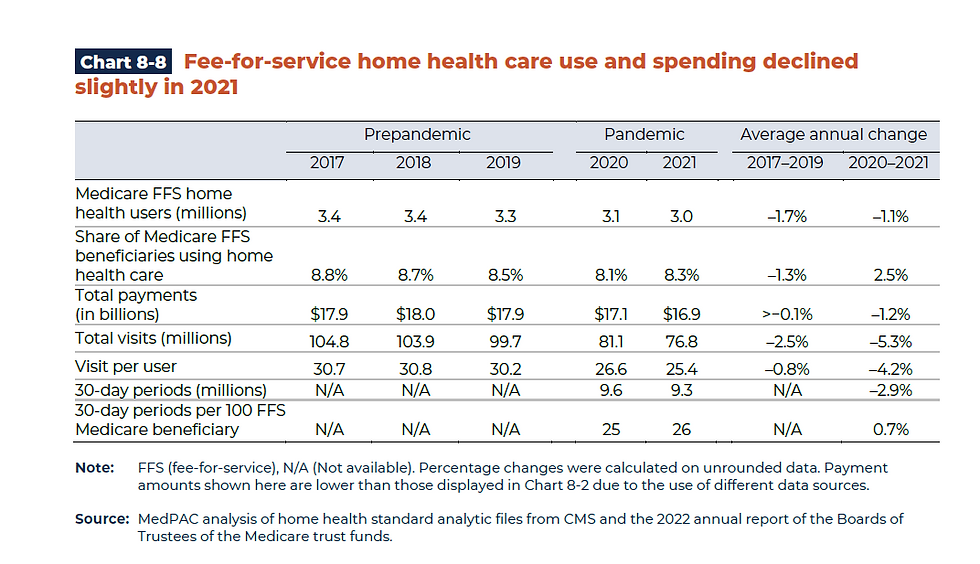

A very small portion of this report relates to home health, but there are basically two charts that relate to the impact of the topic of these CMS cuts to home health and how they are perceived by congress. First, chart 8-8 shows that spending on home health has declined slightly from 2017 - 2021.

Part of this decline is related to the fact that many Medicare beneficiaries are transferring from traditional Medicare to Medicare Advantage. This is mentioned briefly at the beginning of the MedPAC report as it applies to all healthcare sectors.

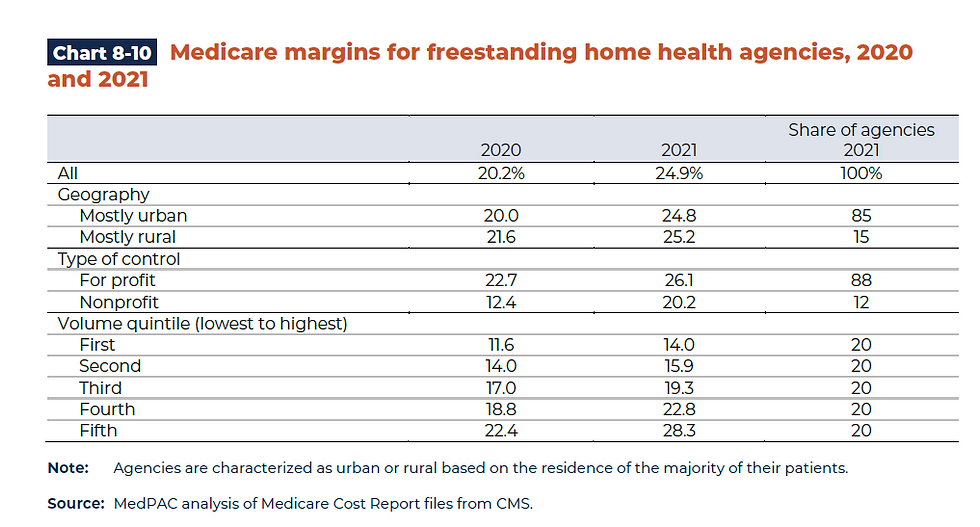

The next chart, and the most important one, shows the “improving” Medicare profitability of home health agencies, especially under PDGM in 2020 and 2021.

Here are the home health Medicare profit margins from 2018 and 2019 from the MedPAC report from 2021:

Based on these reports, not only have home health agencies experienced a significant increase in profits through 2021, but these profits are far greater than those for any other sector of healthcare under Medicare.

If you were a member of the house or senate and were considering this issue, you might weigh these reports and these numbers against what you have been told by home health providers and their advocates.

On the Medicare spending side, you have MedPAC and their data and on the home health advocacy side, you have anecdotes, complaints and predictions of doom. In my opinion, it is clear that home health advocates have brought a knife to a gunfight.

Not only has MedPAC provided data that represents home health agencies as fat and healthy, they are all in when it comes to the CMS cuts. In addition to supporting the permanent adjustments and the current CMS definition of the behavioral adjustment, they are encouraging CMS to begin implementing more cuts to the home health base rate in order to begin collecting on the temporary adjustment balance. So far, CMS has resisted this effort and has not implemented these additional cuts.

As long as these MedPAC numbers continue to represent home health agencies as very profitable, it will be difficult to convince congress otherwise through the collective individual stories of agencies and their advocates. On top of this is the fact that getting any bill passed as a law is becoming increasingly difficult as congress becomes more polarized and dysfunctional.

This will not change until either the MedPAC numbers are challenged or other credible data is available that tells a different story. NAHC recognizes this and has included language in both bills asking MedPAC to begin collecting data on Medicare Advantage and including this data in their report.

This is the key to solving this problem. Fortunately, there is no need to collect this data in future cost reports. It is already there, it was introduced in 2020, it is just not referenced by MedPAC.

In my previous posts, I have already provided data from the cost reports that is in direct contrast to the data provided by MedPAC. This includes cost report data showing the impact of Medicare Advantage on home health financial stability.

In my next post, I will take on the MedPAC 2023 data book directly as it relates to home health and show how this data is biased against home health providers and why.

Comments